2025 EU Market Insight Analysis in relation to the EU F-gas Regulation 2024/573

2025 EU Market Insight Analysis in relation to the EU F-gas Regulation 2024/573

I- Background:

EPEE’s EU Market Insight Analysis has been conducted by Gluckman Consulting, to assess the EU refrigerant pathways under the 2024 EU F-gas Regulation (EU 2024/573).

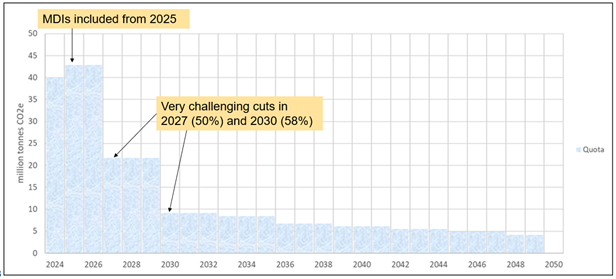

The principle of the 2024 EU F-gas Regulation is good in driving down F-gas emissions and is supported by EPEE. It introduces several new, and sometimes challenging, features including a steeper HFC phase-down, the inclusion of MDIs[1] in the HFC phase down, and numerous new bans (including on export) on certain categories of RACHP equipment.

The data collected provides an understanding of the direction to lower GWP refrigerants in different parts of the RACHP market.

II- Main Findings:

- The EU HFC phase down

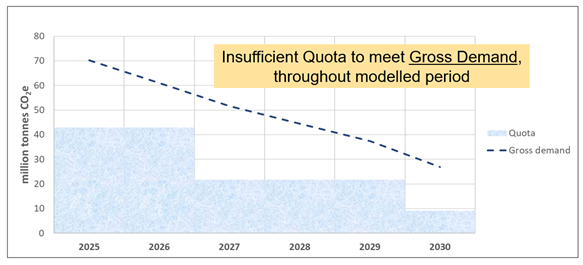

EPEE’s Market Insight Analysis estimates that the virgin HFC quotas will be insufficient to cover gross demand in the coming years. Gross demand represents the total amount of HFCs required in all HFC markets, without taking into account any re-use of recovered refrigerant.

To meet the quota targets, re-use of refrigerant, recovered and properly reclaimed or recycled, is critical to close the gap with the gross demand, due to the fact that the HFC quota system only relates to virgin refrigerants. Unfortunately, very little data is available to confidently estimate the recovery and reuse amount.

Other factors that can influence the availability of quota include the bank of quota authorizations, potential use of IPR[2], illegal imports of HFCs, but also the possible additional allocation of quota for heat pumps and the use of exemptions (safety, LCCP,…).

We recommend carefully monitoring the HFC phase down progress and its ability to meet market needs, transition to lower GWP refrigerants and ensure deployment of renewable technologies, such as heat pumps.

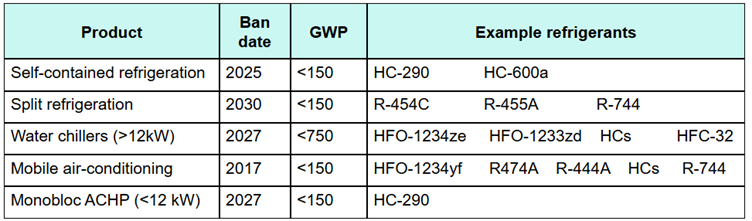

- The Annex IV bans

Product bans are another key driver in the choice of refrigerant for new equipment. The new Regulation defines several ban dates impacting RACHP equipment. For certain technologies, the bans may be achievable, as demonstrated in the table below:

Nevertheless, the transition is expected to be more challenging for other technologies, especially for split air conditioning and heat pump systems:

- Air-to-air single splits under 6 kW have potential to transition to HC-290, but several years of development will be needed for major manufacturers to be able to supply safe and efficient units. In 2024, less than 0.1% of new units used HC-290. Whilst the transition from R-410A to HFC-32 involved relatively small design changes, a transition to HC-290 requires a complete redesign of all components. And due to site-specific safety constraints, it is unlikely that all systems will transition to HC-290.

- Air-to-air single splits between 6 and 12 kW and all multi-splits <12 kW are not suited to HC-290 due to safety constraints and difficulties achieving the best levels of energy efficiency. The refrigerant transition pathway is currently unclear.

- Air-to-water splits do not currently use any HC-290 because the indoor unit is often located in a small space which makes compliance with safety standards very difficult (as the standards take room volume into account). Potential PFAS bans create uncertainty about the use of X-150 blends. A shift from split air-to-water units to outdoor monoblocs is in many cases not possible as building constraints make the use of monoblocs difficult for a significant proportion of properties (e.g. renovation, multi-family buildings, apartment buildings etc.) and also can increase costs significantly if consumers must adapt their houses to use monoblocs.

Several exemptions to the bans are available in the F-gas Regulation, but do not exempt the product from the quota system.

III – Conclusion:

The new EU F-gas Regulation remains highly challenging for the RACHP sector. EPEE’s Market Insight Analysis demonstrates that to meet the phase-down targets, there must be a rapid switch to low GWP refrigerants and/or alternative refrigerants, which is very challenging for many systems. It also requires a significant re-use of refrigerant, recovered and properly reclaimed or recycled, and a successful introduction of low GWP alternatives to current MDIs.

Close monitoring of the market situation is necessary and with this yearly market study EPEE aims to contribute to stakeholder information, market monitoring and EU F-Gas legislation assessment to best portray the state of the art of the available technologies.

For further information or inquiries, please contact the EPEE Secretariat (a.el.azhari@epeeglobal.org)

[1] Metered-Dose Inhalers: “Device used to deliver a specific dose of medication directly into the breathing passages leading to the lungs, commonly utilized by patients with respiratory conditions such as asthma and chronic obstructive pulmonary disease” https://www.sciencedirect.com/science/article/pii/B9781416002031501104

[2] IPR = Inward Processing Relief customs procedure