For the EU and UK, EPEE has developed the HFC Outlook EU model to project pathways for the refrigerant transition in view of the EU F-Gas Regulation.

A modelling tool refined over one decade

The HFC Outlook EU Model has been updated on numerous occasions in order to be robust and to take into account the latest political orientations and technical developments.

The HFC Outlook EU, developed by Gluckman Consulting, carries out detailed modelling of the future markets for refrigerants in the EU+UK. The HFC Outlook EU model is highly regarded, and parallel models are used beyond EU borders. The UN has worked with EPEE and Gluckman Consulting to create country specific models to help Montreal Protocol Article 5 countries prepare their F-Gas reductions plans.

The 2022 version of HFC Outlook EU builds on the initial modelling work done for EPEE in 2012, which modelled a trajectory for an HFC phase-down in the EU in view of the EU F-Gas Regulation adopted in 2014. The 2012 modelling helped EPEE assess the European Commission’s phase-down proposals and showed that the phase-down steps in the 2014 EU F-Gas Regulation were challenging but considered achievable.

Compared to previous versions of the model, the HFC Outlook EU 2022 includes:

- Updated HFC consumption trajectories taking account of the technical developments that have occurred since 2012

- Revised market growth forecasts, especially related to heat pumps.

- Modelling of the energy related GHG emissions from the RACHP market to provide a better understanding of the balance of direct and indirect GHG emissions from RACHP systems.

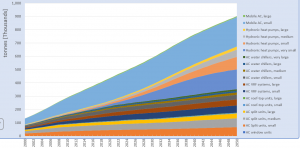

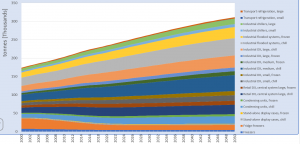

The HFC Outlook EU projections are built bottom-up, providing an analysis of the stock of equipment in more than 50 HFC market sub-sectors. This includes the RACHP sectors and also non-RACHP HFC applications such as MDIs, technical aerosols and foams. EPEE consider that this level of sub-sector granularity is essential for a model to properly take account of the complexity of the HFC market. Even a detailed model of this type simplifies the complex markets for HFCs, but it provides a reasonably comprehensive platform to assess future HFC needs.

The graphs below show the amount of projected refrigerant needed for each of the RACHP sub-sectors in metric tonnes. These could be HFCs, HFOs or natural refrigerants. Each of these sub-sectors will have its own transition towards more environmentally friendly refrigerants.

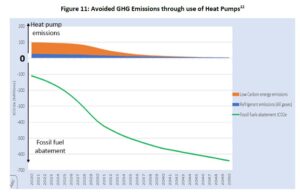

The HFC Outlook EU is also able to calculate the related CO2 emissions of RACHP equipment. As the graph on the top of this page shows that abated CO2 in 2050 from heat pumps systems will be 120 times greater than their direct (i.e. refrigerant) and indirect (i.e. electricity) greenhouse gas emissions.